A visual:

Monday, July 2, 2007

July 2nd, 2007

5 trades, 2 scratches and 3 losers for a net loss of $243.60. Another day where I either closed out winning trades too soon or just jumped out. Also a trade that shouldn't have happened, one of my rules is to never reverse and or chase and that is exactly what I did on my last trade. As a result only 1 car trading until I am back positive for the month. I didn't trade Friday due to stress from my personal life that I didn't' want bleeding over and I might not trade the rest of the week because the volume and action today was just too slow.

June 28th, 2007

2 trades, both losers for a net loss of $257.44. Had 2 stops at the very beginning of the day and stopped trading. I didn't want to be in the wrong mental state for the fed announcement and turn a 250 loss into a 2500 loss. I shouldn't have been trading those setups to begin with, it broke 2 of my rules 1) trading in the first 15min and 2) forgetting that before the fed its pretty choppy but I was a little too confident from the day before.

.jpg)

What today looked like:

.jpg)

Wednesday, June 27, 2007

June 27th, 2007

6 trades today, 4 winners and 2 scratches for a net gain of $162.68. Better day, waited for my setups and executed them, but got out of most way to quickly because of being gun shy after yesterdays losses. Only watching my one time frame certainly helped me stay focused, but my mind was still drifting with other distractions. I wish I didn't have to worry about my p&l so much when I am trading, it would probably help me let those winners run a little bit more.

.jpg)

How it looked:

.jpg)

Tuesday, June 26, 2007

June 26th, 2007

Another down day,9 trades, 2 winners, 5 losers, 2 scratches for a net loss of $504.76. I'm not going to say I over traded and revenge traded was well, but I over traded and revenge traded. I was determined not to miss my setups today, and after missing 1 or 2 early on I just got a little crazy. I need to focus more. From now until the end of July I will only be trading 1 setup, and I will only be looking at that one chart. I think looking at so many different things right now is messing me up.

.jpg)

What today looked like:

.jpg)

Monday, June 25, 2007

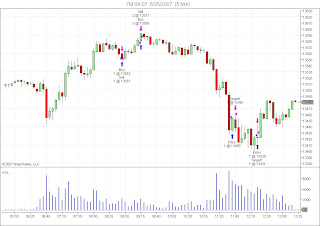

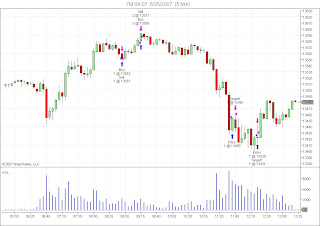

June 25th, 2007

Wow what a fun day, too bad I was being too greedy with my entry's and missed most of my setups, just 2 small scalp trades, both winners for a net gain of $41.28. Impressive no? If I had to guess I would say we go lower on the FOMC news later this week. I think the market character is starting to change from buy on news, whether good or bad to sell on news, whether good or bad. But hey, either way, I'm sure it will be fun to trade. Now my quick take on BX - everyone is calling a top to the market here because of all the hedge funds going public. Maybe, but what I really want to see is if over the next few months they sell a greater percentage of their shares. Up till now, they have been dumping a small slice of the pie, if they dump more, then down the mountain chart we go.

.jpg)

What today looked like:

.jpg)

P.S. - I have been trading the last couple weeks, I just didn't update this online blog. I thought about going back and making new entries off of my offline log, but in the end just started back here.

Monday, June 4, 2007

June 4th, 2007

Wow what a horrid day, 8 trades , 6w winners, 2 losers for a net loss of $833.48. How stupid is that? Well I will tell you. I spent the whole morning and lunchtime being careful picking my spots with small scalps only to give up a huge loss by being stubborn at the end, loading up on size big time and not getting out. Its about as simple as that, I just needed to be disciplined for an extra 90 minutes and we would be talking about my break even say instead of a huge loss. Man I love to trade.

What today looked like:

.jpg)

What today looked like:

.jpg)

Friday, June 1, 2007

June 1st, 2007

New month, 4 trades today, 4 winners and no losers for a net profit of $124.58. I didn't start trading today until after the Consumer Sentiment and ISM Mfg numbers which once again provided some nice volatility. But towards the end of the day the volume really dried up and was hard to believe my data was connected to an open market.

.jpg)

What today looked like:

.jpg)

Subscribe to:

Comments (Atom)

.jpg)